2015 PPAI

DISTRIBUTOR SALES VOLUME REPORT

48 •

PPB

• JULY 2016

GROW

CEO of PPAI. “Our growth speaks to the power and effective-

ness of promotional products as a stand-alone marketing tool as

well as part of integrated campaigns where building strong cus-

tomer relationships is key. While many of our larger distributor

respondents fared best with significant double-digit growth,

segments of the small distributor community were flat and

down year over year. I think these results are reflective of the

investments companies will continue to make to deliver an

omni-channel approach to serving the marketplace. Overall, I

am pleased to see our industry continue to show its strength

and value in an uncertain economy.”

The prediction in recent years that large companies would

keep getting bigger and small companies would decline gained

more of a toehold in 2015. The overall number of companies

with sales less than $2.5 million that report promotional prod-

ucts sales declined to 22,153 from 23,025 in 2014. However,

the number of large companies with sales of more than $2.5

million reporting sales remained relatively stable at 868 com-

pared to 872 in 2014. In addition, the total number of U.S. dis-

tributor companies reporting sales in 2015 was 23,021, slightly

down from 23,896 in 2014.

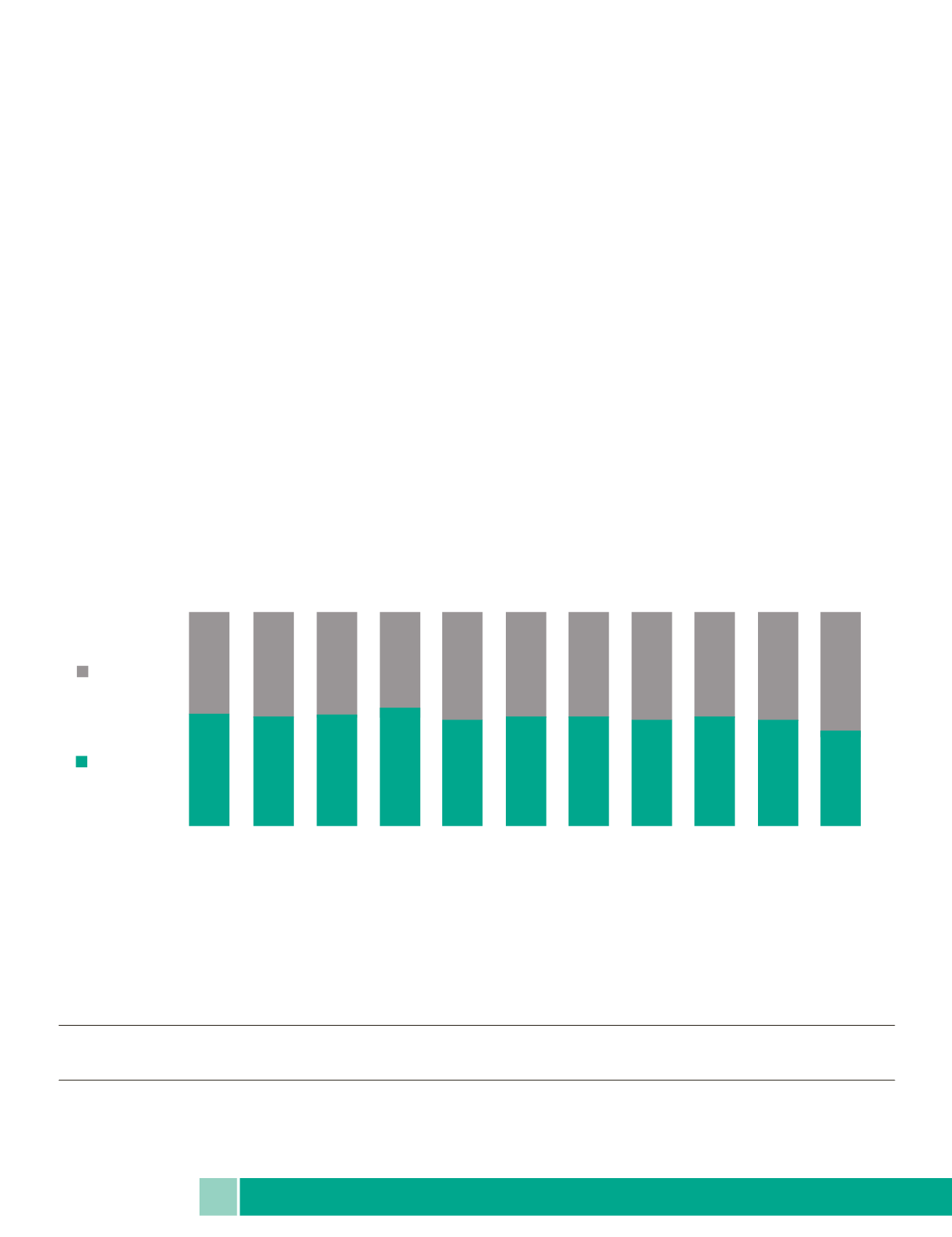

In terms of market share, the 868 firms representing large

companies (sales of $2.5 million or more) captured

$11,551,799,373 of the business—a 55.5-percent share. It

should be noted that the large-company grouping included

franchisors like Adventures in Advertising, Proforma and

iPROMOTEu, and these firms report for their franchisees.

Sales for the smaller distributors as a group amounted to

$9,256,371,349, or 44.5 percent.

For the first time in many years, large distributors accounted

for a larger proportion of the total sales volume than smaller

firms, carving out five additional percentage points of the total

sales performance.

As in 2014, only large companies had positive results by

year-end. Distributors in the $2.5 million-plus bracket recorded

sales of $11.5 billion, showing significant gains at a 14.05 per-

Number Of

% Increase/

Distributor

Distributor 2015 Sales

2014 Sales

Total

Decrease In Sales

Company Size Companies Volume

Volume

Difference

Volume Over 2014

Under $2.5 million

22,153

$9,256,371,349

$9,913,592,681

-$657,221,332 -6.63%

$2.5 million

or over

868

$11,551,799,373

$10,128,636,250

$1,423,163,123 14.05%

Total

23,021

$20,808,170,722

$20,042,228,931

$765,941,791 3.82%

FIG. 3

//

Annual Estimate Of U.S. Distributor Sales In 2015 Vs. 2014

47%

53%

49%

51%

48%

52%

45%

56%

50%

50%

49%

51%

49%

51%

50%

50%

49%

51%

50%

50%

55%

45%

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Over $2.5

Million

Under $2.5

Million

FIG. 2

//

Market Share By Distributor Size 2005-2015