54 •

PPB

• JULY 2016

GROW

ALTHOUGH MANY DISTRIBUTORS ARE OPTI-

MISTIC

about their company’s growth in 2016,

there are fewer who expect increased profit

margins (62 percent) in 2016 compared to

the expectations for 2015 (66 percent), espe-

cially among small distributors. Fewer in this

group have a positive outlook regarding sales

(65 percent) or profit (60 percent) for 2016 in

comparison to 2015 (68 percent and 65 per-

cent, respectively). The downturn in the oil

and gas industry is expected to continue hav-

ing a negative impact on many distributors,

particularly in Texas.

However, companies that participated in

the 2015 survey remain optimistic both

about sales and profits for 2016, especially

large distributors. More than

three-quarters of large distribu-

tors feel confident about their

sales (85 percent) and profit (76

percent) forecast for 2016.

Although, historically, large

distributors are more likely to pre-

dict higher sales and profits for the

upcoming year than smaller com-

panies, there are significantly more

large distributors who predict

higher sales and profit margins for

2016 compared to their predictions

for 2015, while smaller firms’ pre-

dictions remain relatively

unchanged.

PPB

spoke with the principals

at eight small, mid-sized and large

distributor companies to see what

they are expecting economically

for 2016 and to ask about the

challenges and concerns that are

keeping them up at night.

Anita Emoff

CEO and Majority Owner

Shumsky/Boost Rewards

(UPIC: SHUMSKY)

Dayton, Ohio

Company:

Shumsky was founded in 1953

by Hy and Elsie Shumsky, grandparents of

owner Michael Emoff. In 1984, Michael and

his mother, Jayne Miller, took over the com-

pany. Since then Shumsky has expanded into

brand verticals including recognition (Boost

Rewards) and medical recovery pillows

(Shumsky Therapeutic Pillows). Anita joined

the company in 2006 and in 2009 became

president of Boost Rewards. In 2013, Boost

and Shumsky were merged into one entity

with Anita named CEO and majority owner

of the Shumsky and Boost brands. The com-

bined companies continue to grow with a

focus on differentiation (including traditional

and custom promotional products, promo-

tional e-commerce, fulfillment and point-of-

sale) to define their space in the market verti-

cals they serve, which includes technology,

healthcare, automotive/transportation and

retail/consumer packaged goods.

Economic Outlook:

“Our bookings are

up 16 percent YTD and our billings are up

seven percent,” says Emoff. “We expect to

end the year up around 10 percent. Our

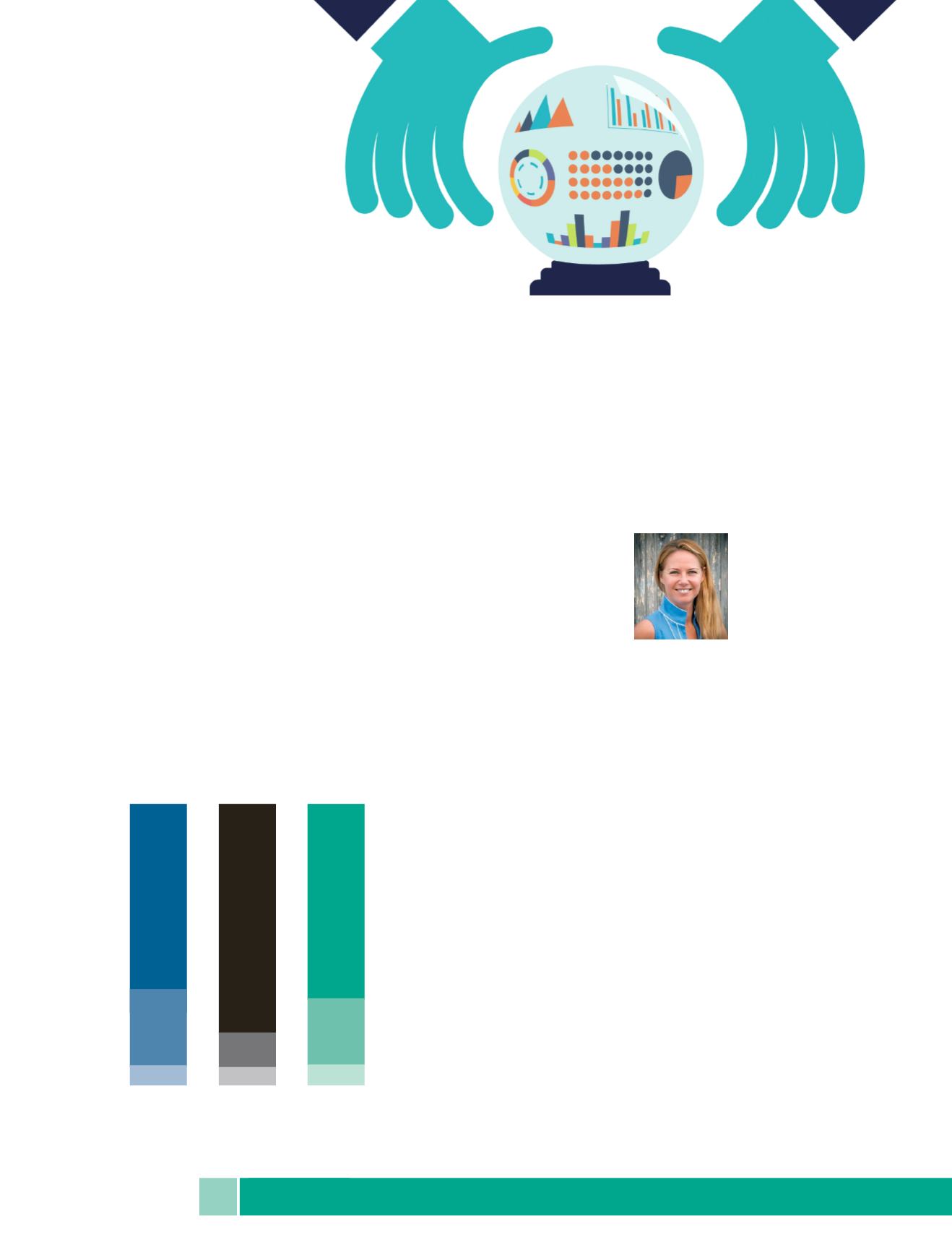

How’s Business In 2016?

Most Distributors

Anticipate Finishing Strong

65%

27%

8%

82%

13%

5%

67%

25%

8%

Greater

Than

2015

Same

As

2015

Less

Than

2015

Under $2.5

Million

Over $2.5

Million

All

Distributors

FIG. 10

//

Distributors’ 2016

Sales Predictions

2015 PPAI

DISTRIBUTOR SALES VOLUME REPORT