JULY 2016 •

PPB

• 49

2015 PPAI

DISTRIBUTOR SALES VOLUME REPORT

cent increase over 2014. On the contrary, the smaller-company

segment saw a greater decline of -6.63 percent, with total

orders of approximately $9.3 billion.

A look by sub-segment reveals that most of the small-com-

pany categories saw a decrease in sales in 2015. The only sub-

segment that experienced positive growth included companies

with sales of $500,000 to $1 million (16.07 percent).

Companies with sales of more than $1 million to $2.5 million

had the biggest decline in sales among all sub-segments at

-20.50 percent.

What About Profits?

Much like 2014, nearly 60 percent (57 percent) of all dis-

tributors saw greater profits over the previous year, but large

distributors saw the biggest wins in profits. In this group, 78

percent indicated they enjoyed higher profits in 2015, com-

pared to 62 percent in 2014, while only 57 percent of the small

distributors did so, remaining at the same level as 2014 (57

percent in 2014). One in five small distributors saw lower

profit levels than in 2014, while a quarter experienced the

same profit level.

The Continued Rise Of Online Sales

Online sales are defined as buys resulting

from orders placed through an online store or

website. Web sales (not to be confused with

salespeople transmitting orders online) are esti-

mated to be $3,944,881,904, or 19 percent of

the industry total sales.

This category of promotional products sales

continued to grow, representing 19 percent of the

sales volume in 2015, up two percentage points

from 17.9 percent in 2014. Total online sales

grew by 10 percent over 2014 to $3,944,881,904,

solely due to an increase in online sales among

large distributors.

However, compared to 2014, the rate of

growth in online sales slowed down significant-

ly in 2015, mainly due to a significant decline

in online sales by small distributors

(-39.5 percent).

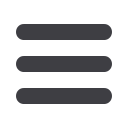

FIG. 4

//

Sales Average (Mean) By Small

Distributors (Less Than $2.5

Million), 2006 – 2015

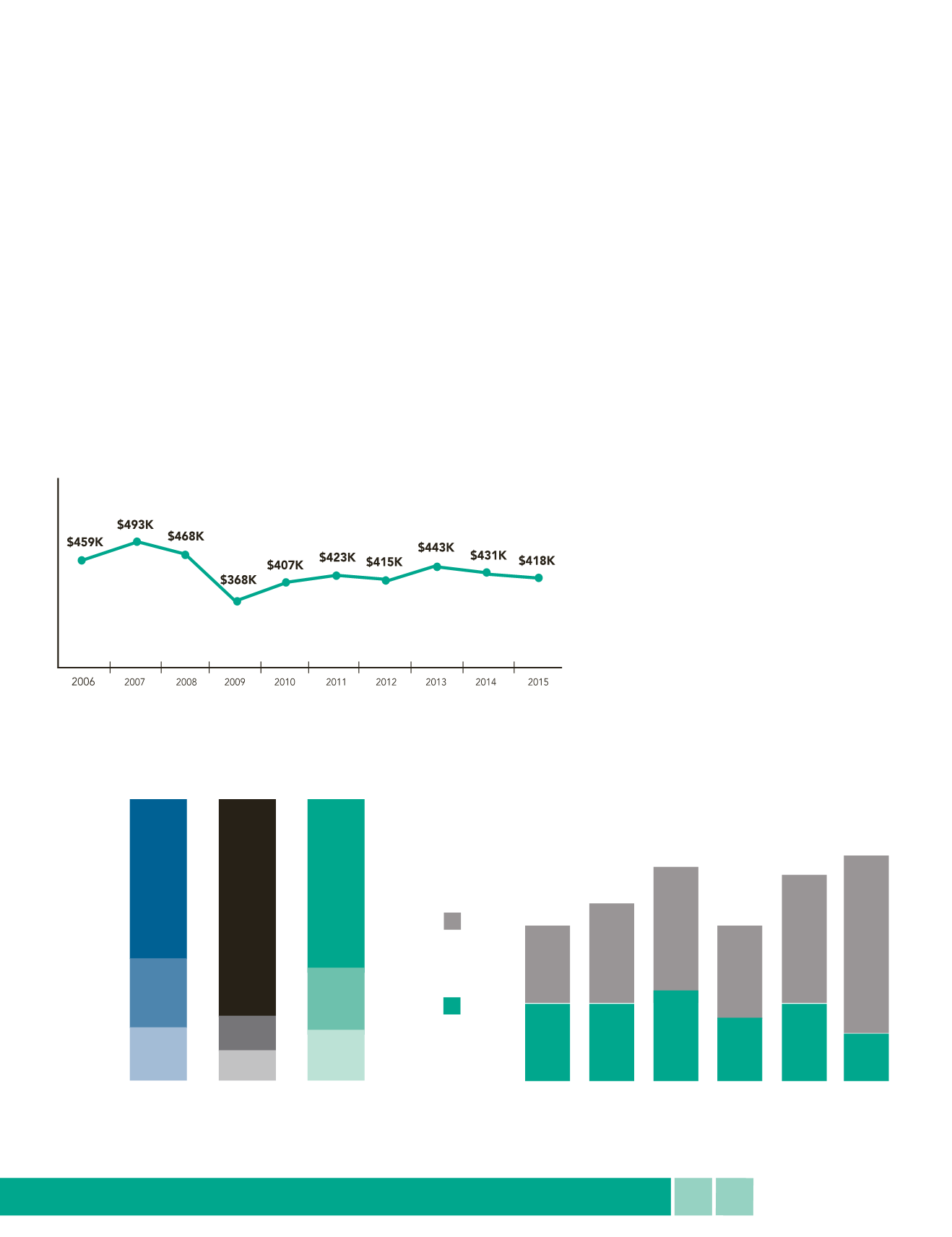

57%

24%

19%

77%

12%

11%

60%

22%

18%

Greater

Than

2014

Same

As

2014

Less

Than

2014

Under $2.5

Million

Over $2.5

Million

All

Distributors

FIG. 5

//

U.S. Distributors’ Profit

Experience, Comparing

2014 To 2015

$1.4B

$1.4B

$2.7B

$1.8B

$1.3B

$3.1B

$2.2B

$1.6B

$3.7B

$1.6B

$1.1B

$2.7B

$2.2B

$1.4B

$3.6B

$3.1B

$0.8B

$3.9B

2010 2011 2012 2013 2014 2015

Over

$2.5

Million

Under

$2.5

Million

FIG. 6

//

Online Sales Contributions

To Distributor Business, 2010-2015