MAY 2016 •

PPB

• 67

business model, are too risky or don’t meet

the requirements of their inventory or

spend. So they ignore them. That’s where

the market almost corrects itself,” he says.

He also believes these Goliaths may

have increased efficiencies but they run the

risk of creating boring products because

those products are safe to buy, easy to

inventory and there’s a market for them.

Out of that environment a space is created

for smaller to mid-sized suppliers to come

in with unique products to round out the

product selection in specific categories. “I’m

very optimistic about where the industry

could go,” he says. “I see an industry of

huge players but I also see an industry of

innovative players because they come to

market with unique product offerings.” He

predicts these innovative companies will

come to market and be able to build suc-

cessful, high-margin and high-growth

companies that fill a product need that the

big suppliers can’t. “It’s not to say they can’t

fill it, but it runs against their business

model in terms of scale and efficiencies—

like fitting a square peg in a round hole.”

For many distributors, the potential

lack of product differentiation and product

innovation is the biggest fear in talking

about consolidation. “Without it, we’d be

competing [solely] on price,” says Graham.

“A supplier may not care about that but

from a distributor perspective, why do I

want to sell the same mug that 25,000 of

my closest competitors are selling? It’s a

race to the bottom. If that’s all I’m relying

on, my business is going to hit a ceiling

pretty quickly.”

He emphasizes the need now and in

the future for both small, unique compa-

nies and also large, turnkey operations.

“Innovation is what cuts through the

noise,” he adds.

BIC’s Bruno predicts fewer players but

larger players if the current scenario con-

tinues to play out. “Consolidation will con-

tinue until we get companies with signifi-

cant market shares,” he says. “The larger

they will be, the more market share they

will gain moving forward.” He also believes

consolidation will reinforce relationships

between large distributors and large suppli-

ers, and that these companies will continue

to become more powerful industry players.

Technology is also seen as a key com-

ponent in a competitive strategy, especially

among small industry players. “We, as an

industry, have to look at the fundamental

relationship between distributors and end

users, and distributors and suppliers, and

look for technology to offer better service,

better products and better solutions,” says

Fandos. “I’m bullish on the industry going

forward, if we can do that.” He adds that

those companies that don’t add value or

add diminishing value to the market are

likely to get squeezed out.

THE INDUSTRY’S POTENTIAL

FIVE-TO-10-YEAR SILHOUETTE

Fast-forwarding to the near future,

Krasovec is another who thinks the indus-

try will improve efficiency most through

the use of technology—especially data-

driven marketing where companies collect

and analyze the buying habits of customers

and market to them based on prior pur-

chases, and individual needs and interests.

“The end product isn’t much different but

the process to get it there is totally differ-

ent compared to five years ago, certainly 20

years ago, and it’s all related to technology.”

Given the industry’s recent history,

Graham thinks the time is ripe to see

some blockbuster acquisitions over the

next two years as the big companies get

bigger by combining resources. He believes

this leaves mid-sized companies in a pre-

carious position—not big enough to maxi-

mize efficiencies and scale but not small

enough to be nimble and innovative. He

characterizes this position as “caught in

the middle.”

“In the next two, five, 10 years we are

going to see the hollowing out of the mid-

dle—it’s a scary place to be,” says Graham,

whose distributorship can best be described

as a small-but-thriving company. “We

strive every day to create a business that is

not in the middle but in its own league.

You could be an average me-too $10-mil-

lion player or be a very differentiated $10-

million player.”

WILL THE INDUSTRY BE BETTER OFF?

“Thoughtful, controlled consolidation

will make us better off but if consolidation

means that in five years we’ll have 10 dis-

tributors and 10 suppliers, I don’t think

that’s good,” says Fandos. “We need

enough companies who bring energy, fresh

ideas and young people into the market.

You want a pipeline. What the market is

telling us with consolidation is it’s not as

efficient as it can be. If we can get more

efficient, and efficiency means safer and

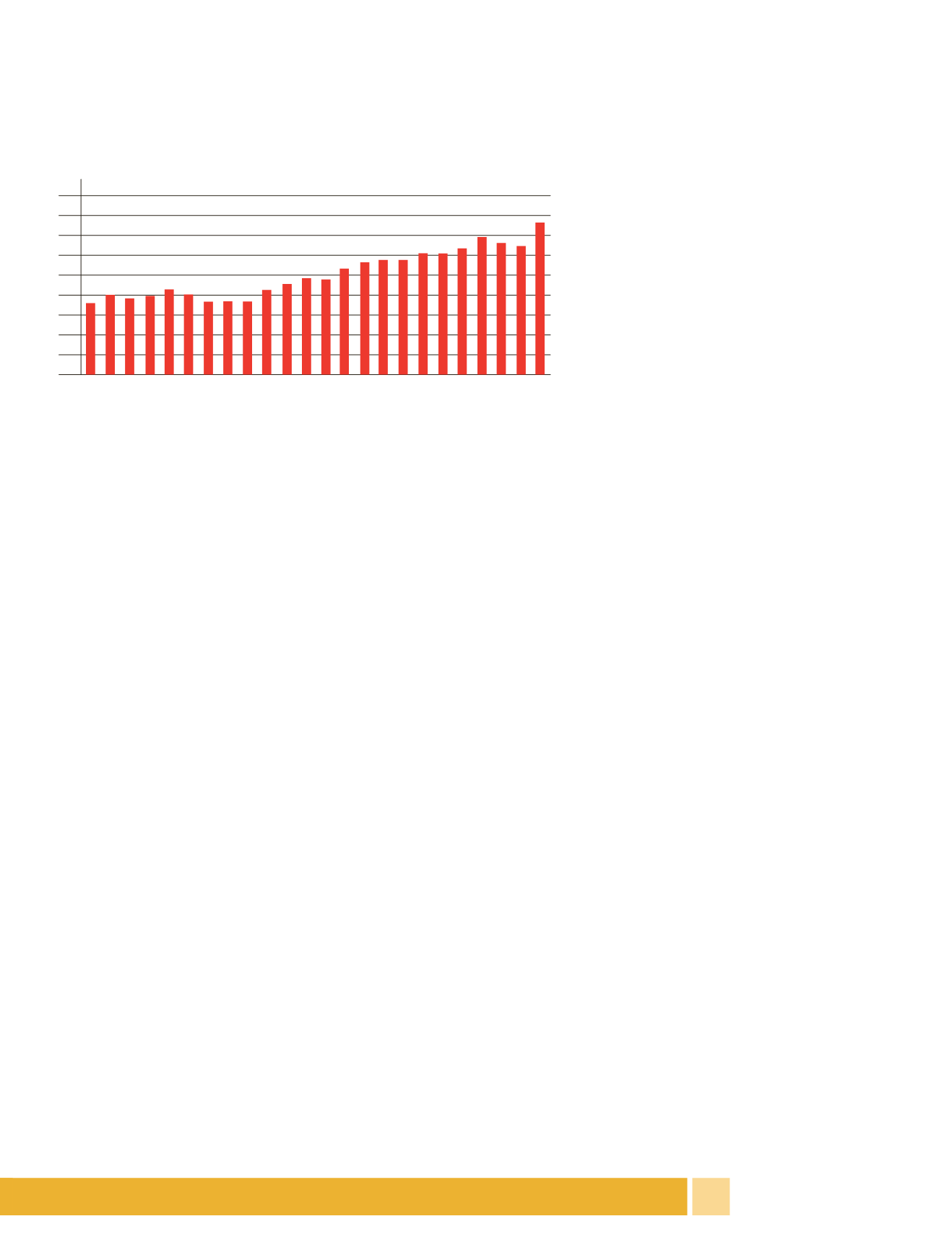

45

40

35

30

25

20

15

10

5

0

Top 25 Promotional Products Supplier Sales as a

Percentage of Total Adjusted Industry Sales*

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

*Total industry sales were discounted 40 percent to arrive at total supplier sales.