66 •

PPB

• MAY 2016

THINK

What makes the industry attractive to

some investors is its consistent profitability,

asserts Frank Krasovec, an Austin, Texas-

based investor and former principal at

Norwood Promotional Products. “It’s an

industry that lets you make money, but on

the supplier side you have to be very effi-

cient to make a profit,” he says, citing the

amount of work required on a typical $200-

$600 order. He thinks that one of the

downsides that can occur with investments

from private equity firms is that they have a

tendency to generalize when they consider

investing in a promotional products supplier

and think they can save money by merging

overhead costs. He says when this happens,

customer service is often glossed over as

though anybody can do it, when in fact

superior customer service is what makes the

difference between preferred suppliers and

everybody else. “If they try to consolidate

plants, they may save money but they lose

customers. In an industry where products

are time-sensitive and personalized, cus-

tomer service is everything. If you mess

with customer service, you are asking for

trouble.” He believes industry investors are

better served by putting money into making

the company’s customer service operation of

the highest quality instead of trying to

reduce costs. “Think big and act small,”

he advises.

However, Woody challenges the notion

that the industry is an attractive buy to

every investor. “We don’t know how many

have looked at the space and said, ‘It’s not

for me,’” he says. “When private equity

investors take a closer look and see the rel-

atively low barrier of entry, the commoditi-

zation of industry products, the threat of

being disintermediated, large advertisers

buying directly out of China and margins

that are challenged, they may conclude it’s

easier to make money somewhere else.”

WHAT WILL CONSOLIDATION MEAN

TO THE INDUSTRY?

Woody remains a skeptic about true

consolidation happening at all in the promo-

tional products industry citing the definition

of an industry that’s ripe for consolidation as

one with relatively high barriers to entry, dif-

ferentiated products, well-established brands

and high profit margins. “None of that

describes the traditional promotional prod-

ucts marketplace,” he says. “Margins are

stressed, products are commoditized and bar-

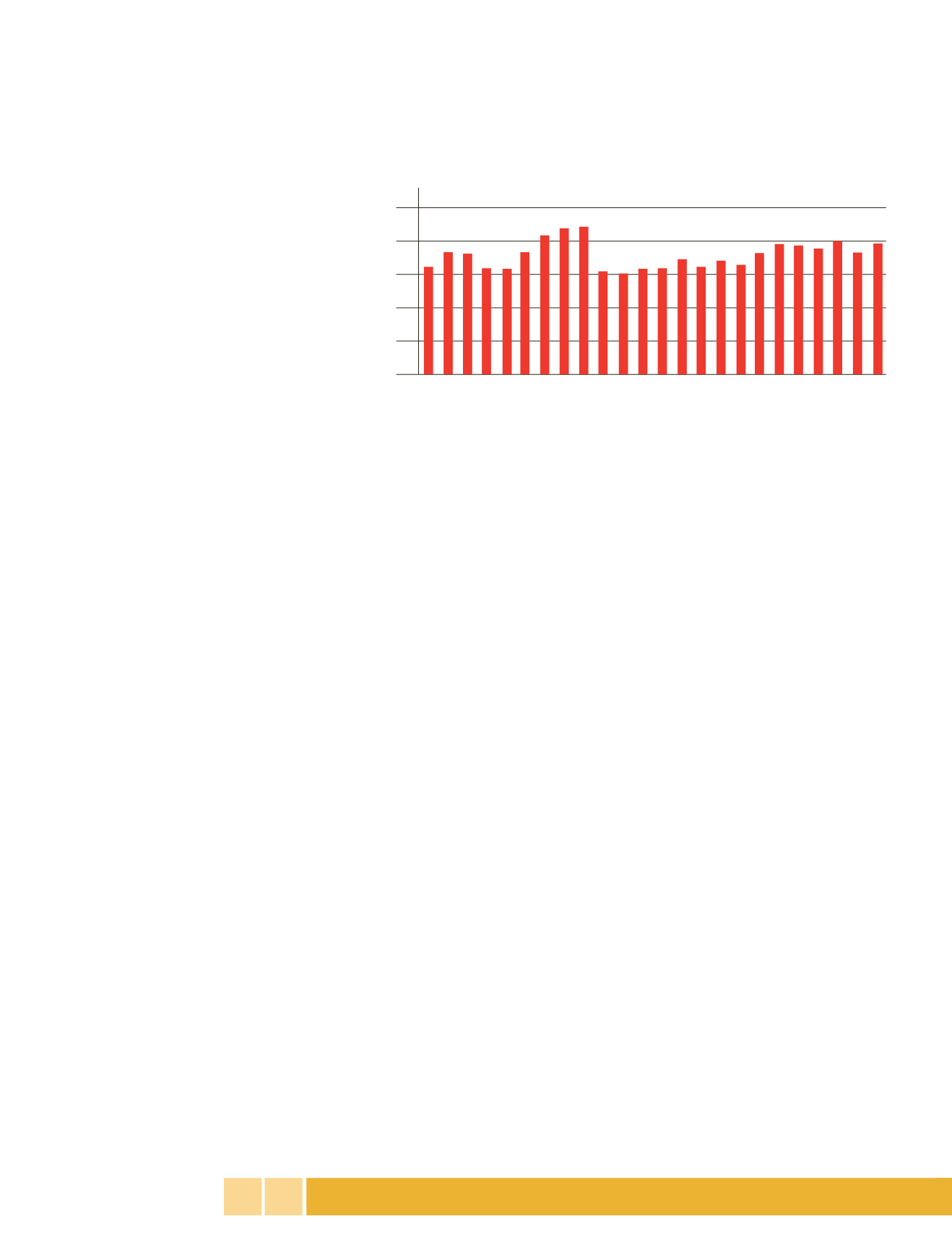

riers to entry are low. I’ve been tracking sup-

plier and distributor consolidation since

1991 [see charts] and it’s clear that if we

define consolidation as most industries do,

there has been virtually no consolidation on

the distributor side and only moderate con-

solidation on the supplier side.”

True to its definition, if consolidation

is happening, it’s likely to create mega

companies and together with the efficien-

cies borne by the collaboration of talent

and systems, will result in companies

poised to do a sufficient job of servicing

their core business. However, the potential

lack of competition could hinder aggressive

pricing to distributors.

Nonetheless, AIA’s Woods sees the

trend as positive, leading to stronger com-

panies that are more equipped to compete,

and because there will be fewer companies,

they are likely to be more competitive and

able to innovate. “Companies that can

remain flexible and able to adapt to end-

buyer needs will continue to do well—

especially distributors with creative

approaches and strong use of technology

and supplier companies with innovative,

new products,” he says.

Brand Addition’s Fandos thinks consol-

idation will actually help the industry from

a product safety point of view. “It will mean

a smaller number of suppliers will have the

ability to drive more margin because of

fewer competitors, and they will be looking

to cut their costs.”Whether good or bad,

another result, he adds, is that those compa-

nies will likely lose their traditional family

feel and become more corporate in struc-

ture and culture. As a result, “They will also

be more financially driven, not emotionally

driven,” he adds. “It’s probably good for

large end user clients but I’m not sure if it’s

good for our industry. But we are a mature

industry and we’ve got to find efficiencies.

Size is often the best way to do that.”

While most industry experts predict

that continued aggregation of supplier

companies, in particular, will lead to the big

getting bigger, some believe there will also

be a very important place for small compa-

nies in the industry’s future. Graham, for

one, is optimistic about that future industry

landscape because of the opportunities it

affords not only to small suppliers but to

distributors. “We’re going to see an emer-

gence of longer-tail-type suppliers—small-

er, innovative companies who come to the

market and get attention with innovative

products that bigger suppliers are not inter-

ested in because they don’t match their

25

20

15

10

5

0

Top 25 Promotional Products Distributor

Sales as a Percentage of Total Industry Sales

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

CHARTS PROVIDED BY MICHAEL WOODY AS PUBLISHED IN IMA MEDIA REPORT.