78

|

NOVEMBER 2016

|

THINK

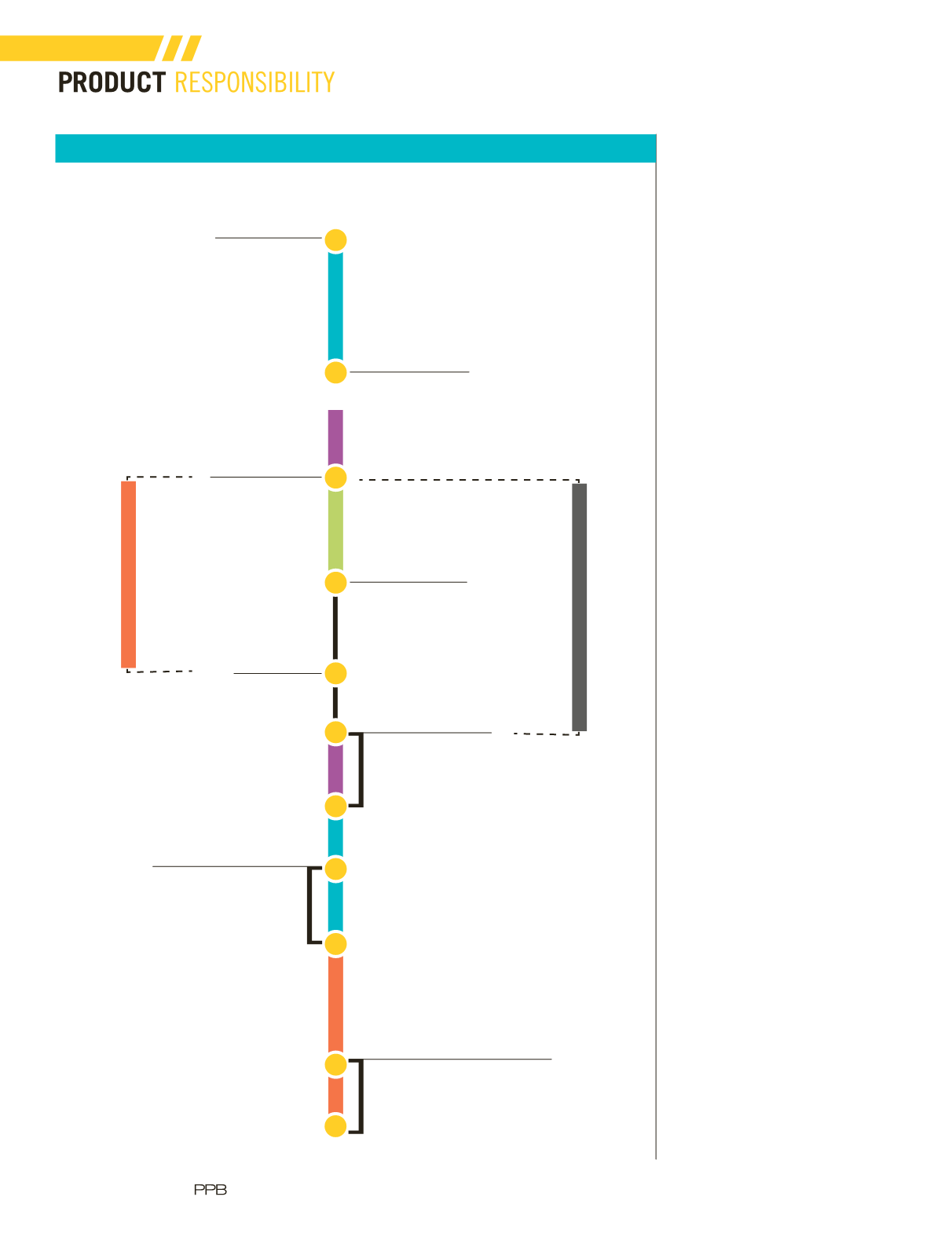

60 DAYS

90 DAYS

30 DAY

S

30 DAYS

45 DAYS

60 DAYS

The ITC also requests

that petitioners include the

following information, to the

extent possible:

• The tariff classification of the

article under the HTSUS;

• A Customs and

Border Protection

classification ruling;

• A Customs entry summary

(Form 7501) indicating

where the article is

classified in the HTSUS;

• A brief and general

description of the article;

• A brief description of

the industry in the U.S.

that uses the article;

• An estimate of the value

of imports of the article

for five calendar years

after the calendar year in

which the petition is filed

(including an estimate

of the total value by the

petitioner and any other

importers, if available);

• The name of each

person that imports the

article, if available;

• A description of any

domestic production

of the article; and

• Other information as

the ITC may require

The process identifies what

the MTB petition “must”

have and what it “should”

have to the extent possible.

Nevertheless, for a successful

outcome, importers seeking

an MTB duty preference

should strongly seek to

provide all of the “should”

information, if possible.

Also keep in mind, members

of Congress can have a product

The New Miscellaneous Tariff Bill Process

OCTOBER 14

ITC requests

MTB Petitions

(Fed. Reg.)

JANUARY 12

ITC publishes

Petitions

APRIL 12

DOC Report

JULY 11 - AUGUST 10

ITC Final Report

DECEMBER 13

Deadline to

submit Petitions

FEBRUARY 26

Last day to

submit public

comment

MAY 12 - JUNE 11

ITC Preliminary

Report

OCTOBER 9 - NOVEMBER 8

Congress must consider MTB

2016

2017

90 DAYS

120 DAYS